Our Science

Sprint brings Science into the Art of Angel Investing

Picking the right investment is an Art. But building an Angel Portfolio is more than that. There's a lot of science that goes into it.

Three fundamental rules

Every investment we pick has to fulfil 3 basic criteria

1

The company should be generating revenues– We strongly discourage investments in companies that are pre-revenue. As Don Peppers himself says, “A business without a paying customer is a hobby”.

2

The investment round should be having a reputed Lead Investorand should be ideally a 2nd round of investment– 90% startups fail after their 1st round of investment, and typically the 1st round is usually a Friends & Family round, where the investment is person-driven and does not necessarily validate the idea.

3

Strict Due Diligence across Legal, Financial, Compliance and Business model to ensure business model is viable, all compliances with the law of the land have been followed, and there are no red flags on legal or financial matters and documents of the company.

Impact of Portfolio Size on Loss Minimization

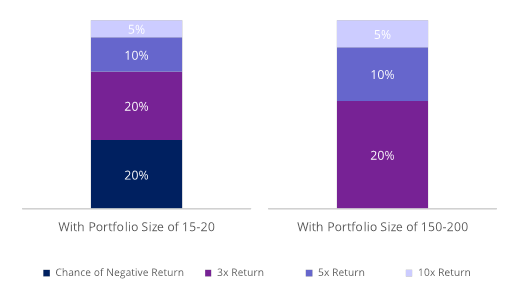

Based on a study done across 26000 Investments by VCs, and their outcomes, we see the following pattern.

What this suggests is that VCs with typical portfolio size of 150-200 eliminate the chance of Negative Return to 0%, without sacrificing the possibility of a 3X, 5X, or a 10X return.

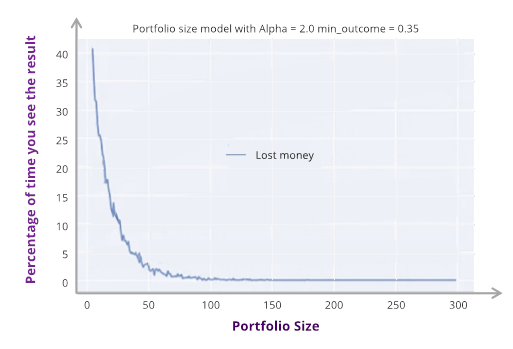

Another way to look at this would be to look at the lowest outcome across all funds with a given portfolio size

This shows that for all VCs with portfolio size above 100, the actual number of them which lost money tend to 0%, or put another way,no VC with portfolio size above 100 has lost any money for its investors.

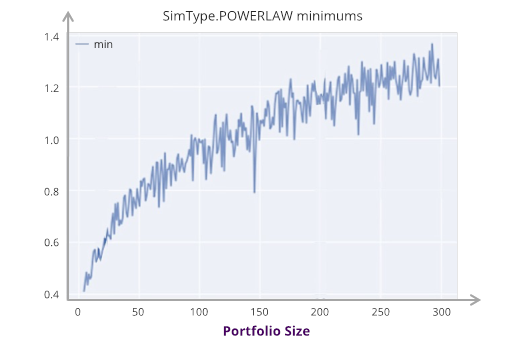

Impact of Portfolio Size on Minimum Expected returns

Diversification also has a role in increasing the minimum expected returns from the portfolio.

The graph here shows that VCs with a portfolio size of 50 companies delivered a minimum return of 0.75X, implying a loss of 25% on capital; whereas VCs with a portfolio size of 100-200 delivered a minimum return of 1X – 1.2X, implying a 0% loss on capital to a minimum of 20% gain on capital.

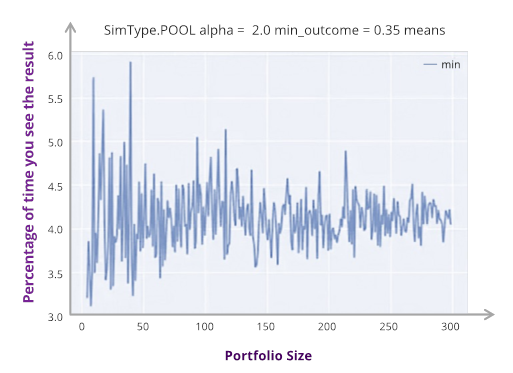

Impact of Portfolio Size on Variation of returns

The range of returns if further affected by the portfolio size.

The graph here shows that VCs with a portfolio size of 25-50 companies delivered a median return ranging between 3X-4X with a high degree of variation; whereas VCs with a portfolio size of 100-200 delivered a median return ranging between 3.5X – 4.5X, with a far lesser degree of variation, thereby leading to a higher predictability of outcome.

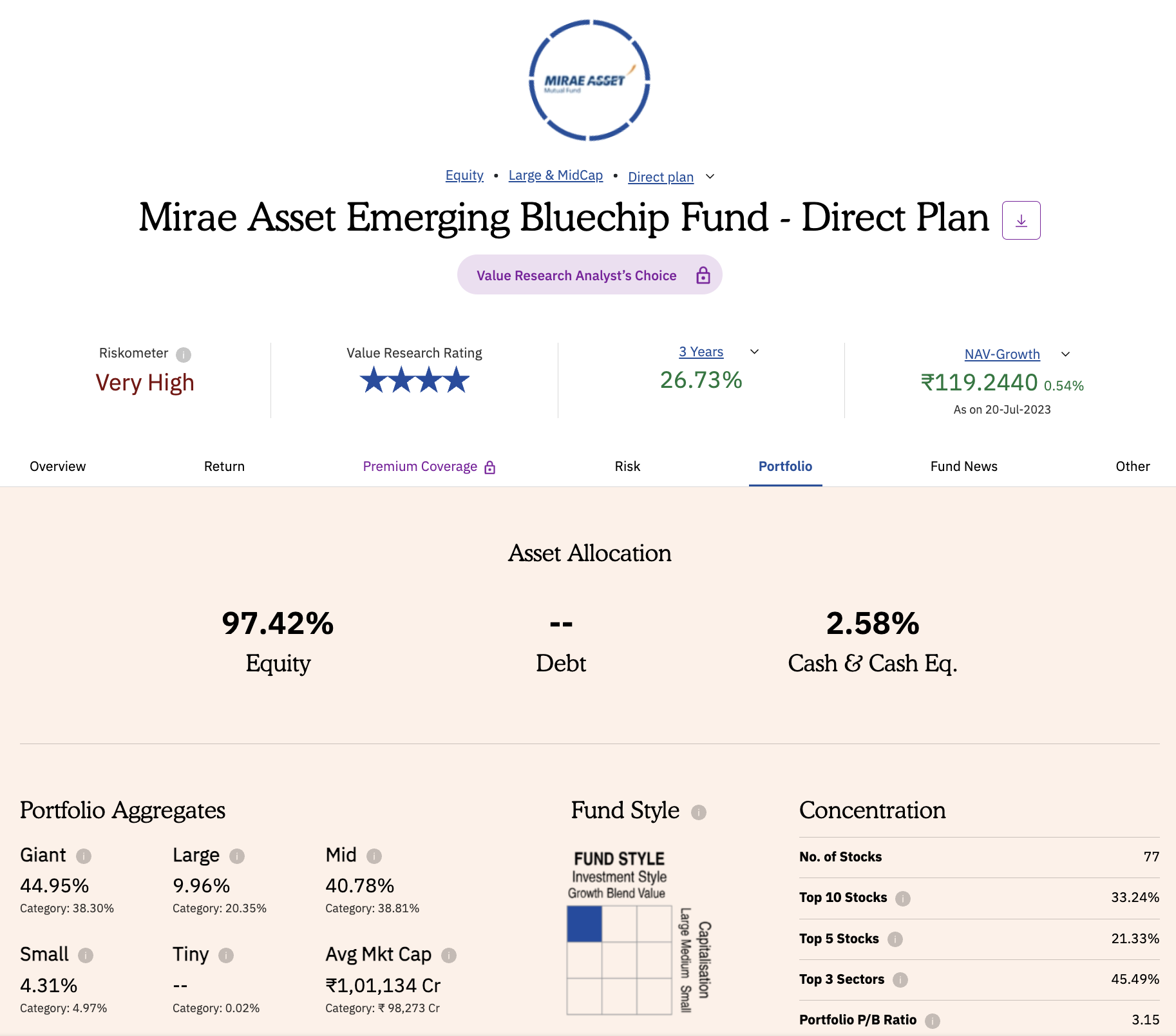

Diversification by Mutual Funds - An Inspiration

A top quartile Mid-cap heavy fund

Portfolio Size – 73 Stocks

A top quartile Large-cap heavy fund

Portfolio Size – 70 Stocks

A top quartile diversified fund

Portfolio Size – 77 Stocks

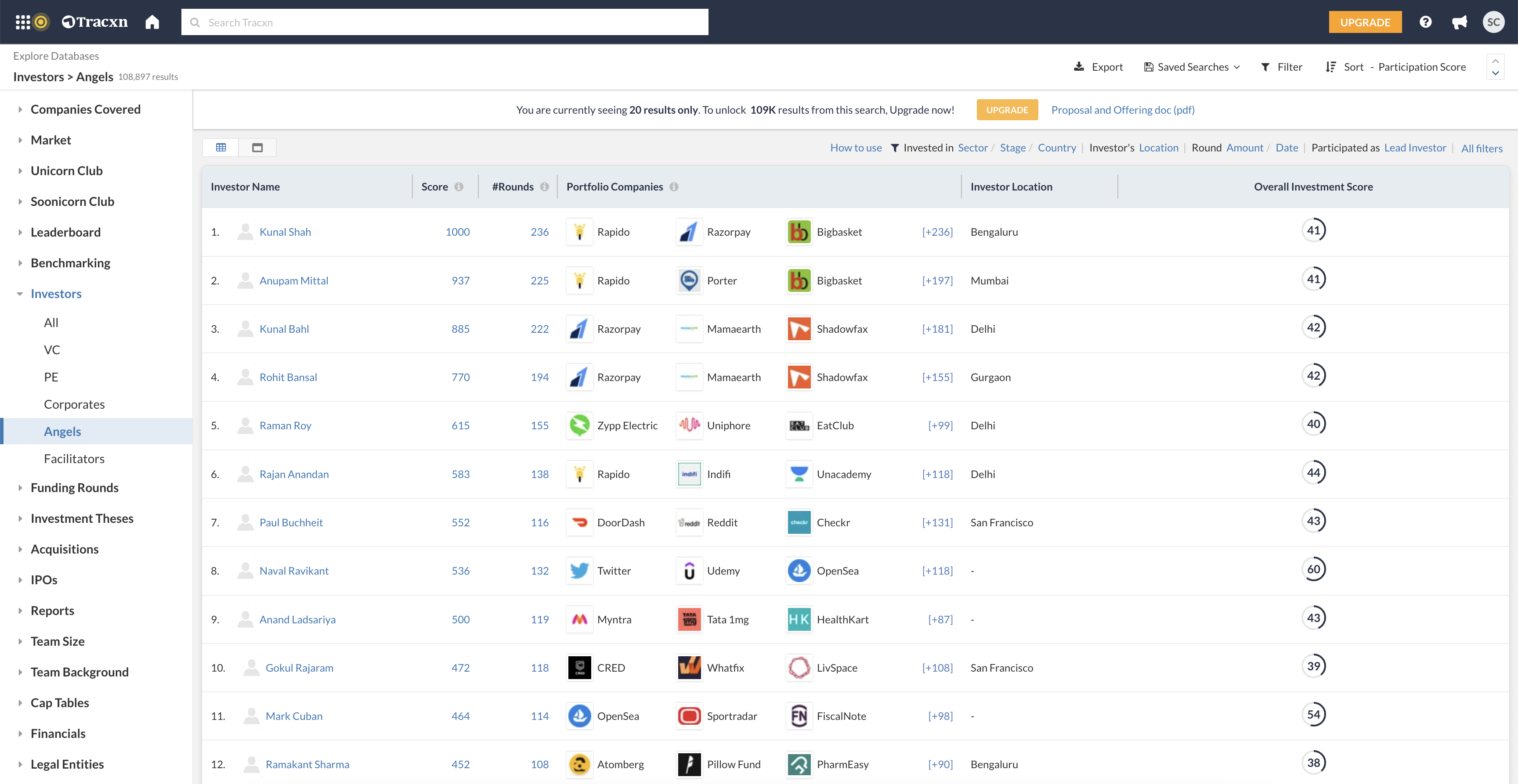

Diversification by Prolific Angel Investors

135

Average Number of Investments

Making Angel Investments a predictable asset class

An investment avenue becomes a viable asset class when the returns from that asset has predictable outcome. Through the Angel SIP model and our Portfolio Design and the Portfolio Construction process showcased above, Sprint is targeting a predictable outcome from its Angel Portfolios.

Controlled

Risk

+

Diversified

Approach

=

Predictable

Outcome